│QuickBooks Overview

│QuickBooks Overview

QuickBooks is a cloud-based accounting software targeted toward small businesses. It helps business owners track finances, analyze data, stay on top of taxes, and complete payroll.

With its range of subscription plans and add-on services, QuickBooks is a functional, flexible and scalable software solution. It provides new and established businesses with the tools needed to maximize profitability.

Read our QuickBooks review to learn more about this accounting software and determine whether it’s the right fit for your business.

QuickBooks – Best for small businesses  | QuickBooks is an excellent option for small businesses. It’s simple to use and can scale up your business. You can start with the basic subscription plan and upgrade as and when you need it. |

│QuickBooks Pros and Cons

│QuickBooks Pros and Cons

Before diving into the ins and outs of QuickBooks, let’s examine its main pros and cons.

QuickBooks Pros

Track money coming in and out

Track money coming in and out

Track income from your bank, external applications, and QuickBooks payments. Manage all your bills in one place and use your phone to snap and save photos of receipts.

Create automated invoices

Create automated invoices

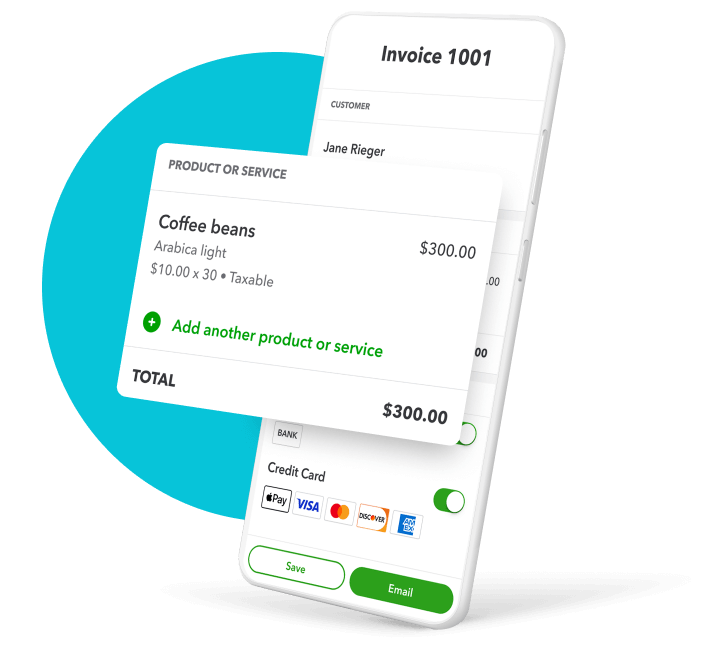

Allow customers to pay online via credit and debit card, eCheck, and ACH payments. Add branding to invoices and automate recurring invoices for maximum efficiency.

Forecast expenditure and profit

Forecast expenditure and profit

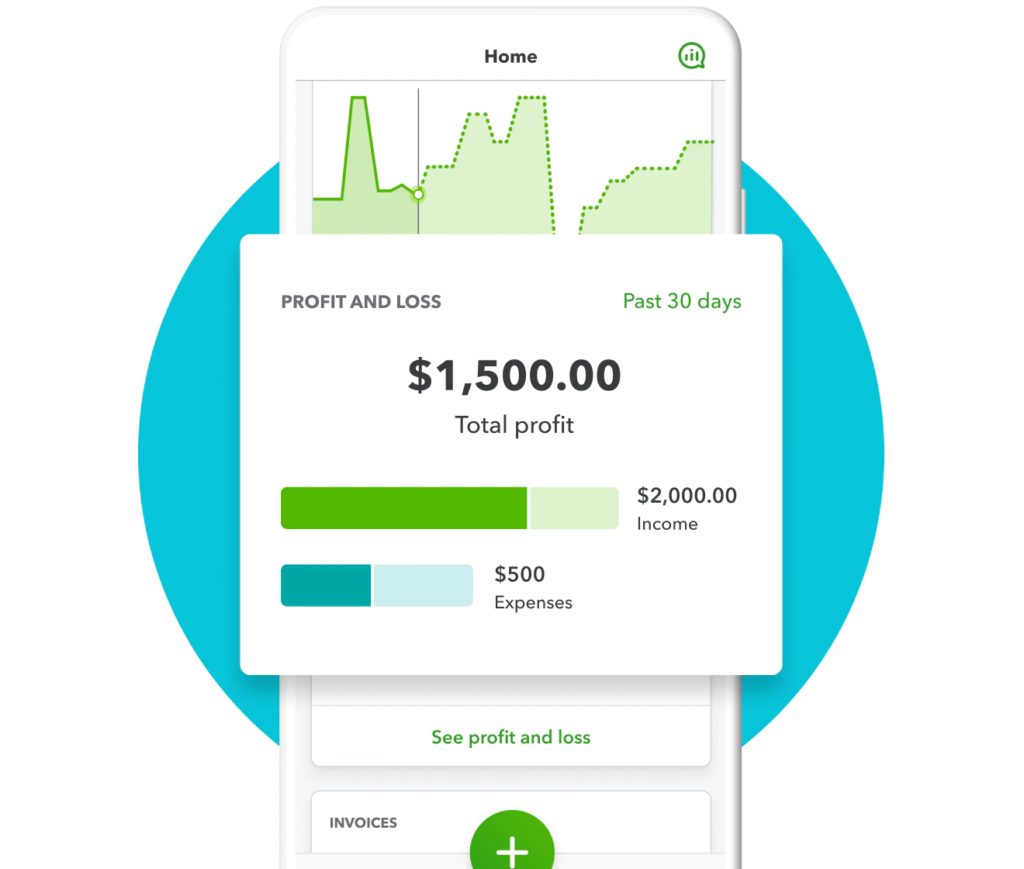

Forecast cash flow to plan and gain insights into your finances. You can also project the profitability of individual projects and track the costs involved from one centralized location.

Access customized reports

Access customized reports

Run and export profit, loss, expense, and balance reports to gain an overview of your business’s financial health. Tailor these reports to make them work perfectly for you.

Manage your inventory

Manage your inventory

Track products and receive notifications when inventory is running low. QuickBooks analyses spending patterns and highlight the most popular and profitable products.

Run fast, unlimited payroll runs

Run fast, unlimited payroll runs

QuickBooks takes care of your payroll and automatically calculates tax on every paycheck. Employees can access their pay stubs via the workforce portal for increased transparency.

Take care of your team

Take care of your team

QuickBooks incorporate perks like retirement plans and health benefits into their payroll services. They also offer a personal HR advisor to ensure your team feels supported.

Take advantage of helpful resources

Take advantage of helpful resources

There’s a range of valuable resources offered by QuickBooks, including training videos, webinars, classes, blogs, demos, etc.

QuickBooks Cons

Subscription plans are expensive

Subscription plans are expensive

Subscriptions start at around $25, which is more costly than alternative accounting software.

There’s a steep learning curve

There’s a steep learning curve

Users have found QuickBooks to be quite complex to use. It may take a while to familiarize yourself with the software and maximize its potential

| QuickBooks Advantages | QuickBooks Disadvantages |

|---|---|

Why wait? Try QuickBooks Today!

QuickBooks is one of the most popular accounting solutions on the market. It’s highly scalable and can be an invaluable tool for businesses looking to expand their operations.

│What is QuickBooks?

│What is QuickBooks?

QuickBooks is an accounting software package developed by Intuit. It’s mainly marketed toward small and medium-sized businesses. It offers cloud-based accounting applications for increased flexibility.

Its products suit all levels of expertise, industry, and business size. At its core, it’s a basic bookkeeping solution, but thanks to its impressive features and countless add-ons, QuickBooks is so much more.

It helps businesses in key areas of financial management:

- Tracking income

- Tracking expenditure

- Analysis and reporting

- Managing inventory

- Time tracking

- Automating payroll

- Calculating taxes

│How Does QuickBooks Work?

│How Does QuickBooks Work?

Once you’ve created a QuickBooks account, you can log in to your account and access the main dashboard. You can easily import existing files from previous accounting software to your new account.

You can view a summary of your QuickBooks account from the main dashboard. The dashboard contains two tabs: a workflow and an overview tab. From the workflow tab, you can view outstanding tasks and see a clear step-by-step of your money’s financial journey. The overview tab shows profit and loss, expenses, invoices, sales, and bank accounts.

You can connect to your bank and existing apps for faster reconciliation and payment processing. You can also customize invoices, input bills, and access all of QuickBooks’ inbuilt and external features.

Invite a bookkeeper or accountant to your QuickBooks account through the ‘My Accountant’ tab or the ‘Manage Users’ page. Once you’ve configured the platform to suit your requirements and have connected the necessary people, you’re ready to go.

│QuickBooks Features

│QuickBooks Features

The great thing about QuickBooks is that it has an end-to-end suite of accounting tools. QuickBooks can provide your entire accounting network. Having this continuity makes for smooth data flow and increased usability.

Below, we will take a more in-depth look at the key features of QuickBooks and how they can help your business thrive.

Manage Bills

Manage Bills

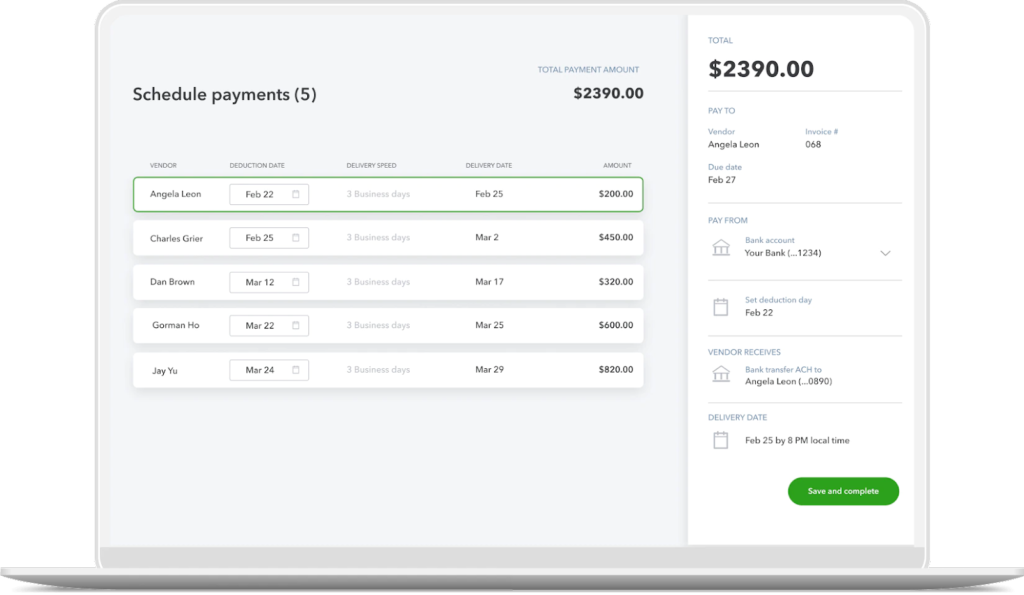

Organize, track, and pay bills with confidence. QuickBooks keeps you updated on upcoming bills and matches payments to vendor invoices. You can pay bills online via bank transfer or debit card and schedule future payments.

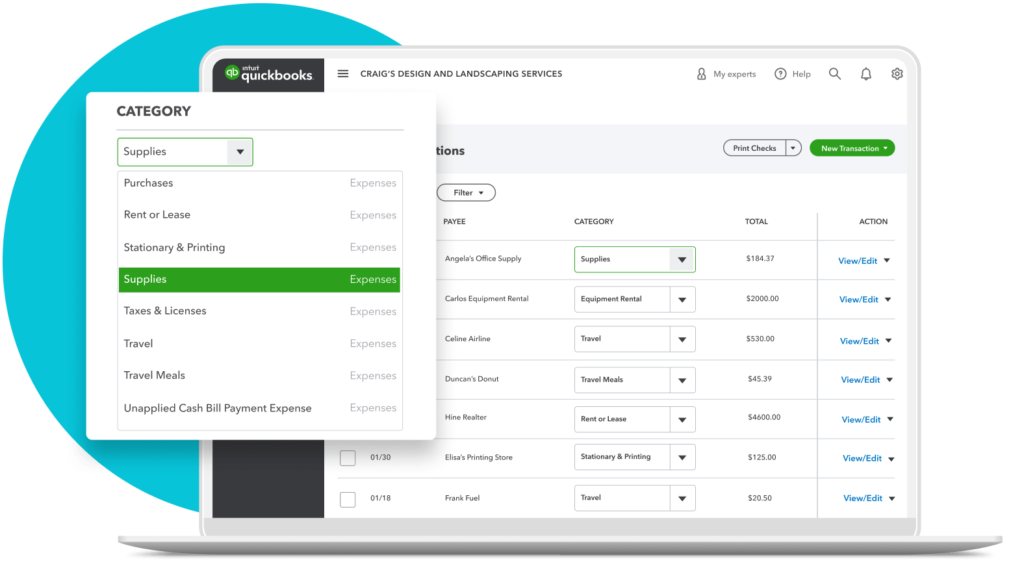

Track Income and Expenses

Track Income and Expenses

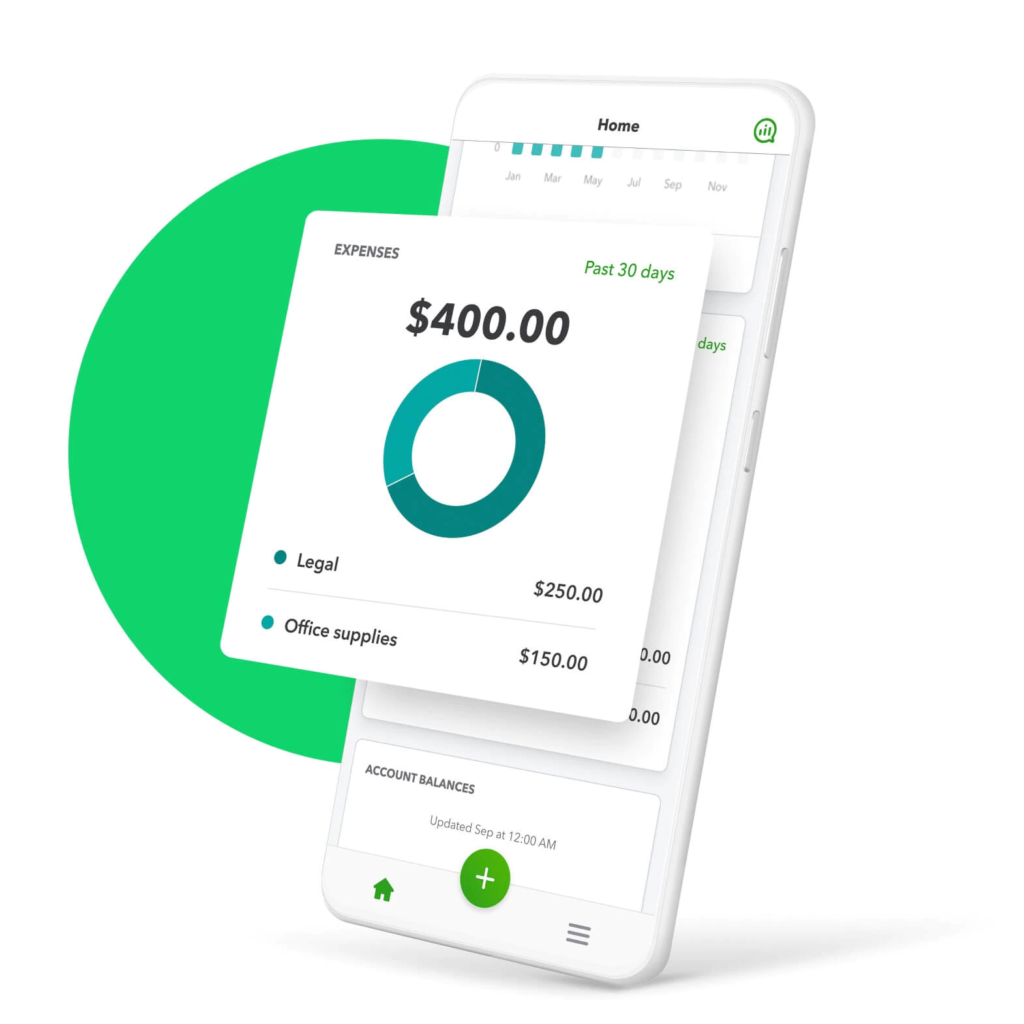

QuickBooks allows you to track all incoming and outgoing money for increased visibility over your business’ finances. Connect to your bank accounts and let QuickBooks import and categorize expenses. Create custom rules for expenses and run reports to see spending patterns.

Invoice Customers

Invoice Customers

Create and send professional invoices and get paid twice as fast with QuickBooks Payments. Personalise invoices with your logo and colors and automatically add billable hours with ease. Send invoices directly from the app and receive notifications for late payments.

Run Reports

Run Reports

Monitor cash flow and business performance with QuickBooks’ fantastic reporting tools. Gain a holistic view of your financial health with cash flow statements, income statements, and balance sheets. Customize reports to suit your business model and access everything you need from your dashboard.

Maximize Tax Deductions

Maximize Tax Deductions

Categorize expenses automatically using QuickBooks tax categories to simplify tax management. Snap and store receipts to funnel them into tax categories automatically. Receive automatic tax calculations and organize essential documents to make accounting effortless.

Why We Need to Use QuickBooks

QuickBooks Can Work For Your Business!

Quickbooks are the industry standard for business accounting software. They make it easier to keep thorough records and stay on top of your finances.

│Who Should Use QuickBooks?

│Who Should Use QuickBooks?

Quickbooks has subscription plans and add-ons for every type of business, regardless of size or industry.

Add-ons such as a dedicated bookkeeper or accountant mean that even those with less accounting experience can benefit from Quickbooks’ services for an added fee.

There are plans for new, small and mid-size businesses and freelancers.

New businesses

New businesses

Quickbooks give new business owners the confidence to manage their finances. Add additional features like payroll as and when you need it to avoid becoming overwhelmed. View income and expenses clearly on the dashboard and enjoy Quickbooks’ many handy resources. For example, they offer articles on starting a business and writing a business plan.

Small Business

Small Business

The Simple Start or Essentials plans are ideal for small businesses and offer the perfect level of functionality without being excessive or complex. Upgrade your plan as your business expands and experience software that moulds around you. Streamline the set-up process with a Live Bookkeeper and access continued support at any stage of your business journey.

Mid-Size Business

Mid-Size Business

Customizable solutions like robust accounting, time-management, and bookkeeping support help medium-sized businesses grow at their own pace. With Quickbooks, you can also apply for financing to propel your business toward success. Quickbooks can integrate with many existing software products, and you can set permission levels based on employee level. They even offer an eBook that explores the secrets to growing your mid-sized business.

Freelancers

Freelancers

The Self-Employed plan gives self-starters and small businesses the tools they need to get ahead of the competition. These plans are flexible and suitable for independent contractors and freelancers. Features include separating business and personal expenses, estimating tax calculations, tracking mileage, and more.

| Usage |

|---|

Use QuickBooks For Making Tax Digital!

Quickbooks’ innovative accounting software can help you digitize tax management. From invoicing and expenses to VAT and payroll, Quickbooks can help your business today.

│QuickBooks Time and Cost

│QuickBooks Time and Cost

You can set up a Quickbooks account and access their accounting services in minutes. Its simple interface and detailed guides make navigating Quickbooks a breeze. Book a 45-minute onboarding session with one of their experts to make settling into Quickbooks even faster.

Quickbooks subscription plans range from $25 to $180. You need to pay an additional fee to access additional services like payroll. There are cheaper options on the market, but none offer the same broad selection of features.

│QuickBooks Usability

│QuickBooks Usability

A significant appeal of QuickBooks is its ease of use. Usability is one of the many perks that have made QuickBooks a global success.

The entire interface of QuickBooks is intuitive and user-friendly. The dashboard contains handy shortcuts to essential tasks, such as adding invoices, receipts, and bills. You can instantly see your bank balance and general cash flow from the dashboard.

Quickbooks predicts cash flow based on recurring invoices and bills to help you prepare for upcoming expenditures. You can view your financial data in a visual format through charts.

A powerful search function also allows you to search for particular data entries by name, address, transaction value, date, etc. This can be a huge timesaver and a handy tool for your accountant or bookkeeper.

Connectivity is also a major advantage of Quickbooks. It connects seamlessly with your current apps, and you can give your accountant access to your profile with ease.

If you require additional support, the Quickbooks support hub is an excellent source for articles, videos, demos, etc. You can also receive expert support from QuickBooks Live, a service that pairs you with a qualified bookkeeper who can oversee your finances on your behalf.

│QuickBooks Pricing

│QuickBooks Pricing

Quickbooks has four main subscription plans, a dedicated self-employed plan, and separate payroll plans. There’s no fixed contract, and you can upgrade or downgrade at any time. All the plans include free mobile apps, QuickBooks support, and app integration.

You can also access a 30-day free trial, and there are often discounts, like 50% off any plan for the first three months.

Subscription Plans

Simple Start

Simple Start

The Simple Start is for one user and costs $25 p/m; it’s the most basic subscription plan offered by QuickBooks. With this plan, you can track spending, create invoices and make payments. You can also access reports, capture receipts, track mileage, and calculate tax.

Essentials

Essentials

The Essentials plan contains a few extras. The reporting capabilities and bill management features are more advanced. You can also track projects by time and use this to inform invoices. The plan is for three users and costs $50 p/m.

Plus

Plus

The Plus plan costs $80 per month, giving you extra features like inventory management and profitability forecasting. It also allows for five users.

Advanced

Advanced

On top of the features mentioned, the Advanced plan gives you business analytics, batch invoices, workflow automation, and more. Over five users can access the account, and custom permissions enhance data protection. You can also access a dedicated team and training whenever needed. The plan is the priciest at $180 p/m.

Self-Employed

Self-Employed

The Self-Employed plan costs $15 p/m and is designed for freelancers and independent contractors. It helps you stay tax-time ready, uncovers tax deductions, and keep tabs on your finances. You can track income/expenses, capture receipts, estimate taxes, run reports, and track miles.

Payroll

Core

Core

Payroll Core includes fast, unlimited payrolls and regular reports. It calculates paychecks and comes with a Workforce Portal for employees. Calculate, file, and pay taxes automatically with QuickBooks Payroll. You can also incorporate health benefits, retirement plans, and direct deposits into your payroll. Core costs $45 p/m, plus $4 per employee per month.

Premium

Premium

Payroll Premium contains all the above plus workers’ comp administration, assistance from the HR support center, expert reviews of your payroll, and employee time-tracking. It costs $75 p/m, plus $8 per employee per month.

Elite

Elite

Payroll Elite grants you an expert to set up your payroll for you, 24/7 product support, and a personal HR advisor. It tracks and manages projects and gives you tax penalty protection. Payroll Elite costs $125 p/m, plus $10 per employee per month.

| Subscription Plans | |

|---|---|

| Yes | |

| $25 per month | |

| $50 per month | |

| $40 per month | |

| $180 per month | |

| $45 per month | |

| $75 per month | |

| $125 per month |

Give QuickBooks a Go!

If you’re a small business looking to manage your finances, QuickBooks is the perfect solution. Their software provides all the tools you need to stay on top of your income, spending, and taxes!

│How Can QuickBooks Help My Business?

│How Can QuickBooks Help My Business?

QuickBooks has an array of unique tools to help your business thrive.

Business Bank Account

Open a QuickBooks checking account to the bank directly through QuickBooks. These accounts offer 1% APY interest, instant deposits, entry-free bookkeeping, cash flow projections, and more. They integrate seamlessly with other Quickbooks products, are easy to set up, and come with unlimited customer support.

Business funding

You can apply for business loans through QuickBooks. It only takes minutes to apply, and there are no origination fees, prepayment penalties, or hidden charges. If you’re eligible, you could apply for a loan of $5-$15K and repay it over 6-18 months.

Mileage Tracking

Mileage can be a significant tax deduction for small businesses. Automatic mileage tracking is built into Quickbooks to help you record your journeys and claim back travel expenses. The QuickBooks app tracks your journeys using GPS and categorizes your miles as business or personal.

| Points to Note |

|---|

│QuickBooks Use Cases

│QuickBooks Use Cases

Modern Auto

Modern Auto

Modern Auto adopted QuickBooks to streamline payroll. They cut the time taken to complete payroll from two hours to around twenty minutes, thanks to QuickBooks Payroll.

Nzilani Glass Conservatory

Nzilani Glass Conservatory

Nzilani Glass Conservatory wanted to predict future profits and expenses. With QuickBooks, the profit-and-loss comparison helped them see the long-term vision of their company’s financial health.

A Sacred Space

A Sacred Space

This candle company found that tracking their finances in a spreadsheet was becoming increasingly difficult as their business grew. They turned to QuickBooks Live and were matched with an experienced, certified bookkeeper.

│QuickBooks Support

│QuickBooks Support

QuickBooks offers great customer support to help you take full advantage of their software. You can access videos and step-by-step guides for every feature of QuickBooks. There are also webinars and training classes for those seeking to improve their accountancy skills.

As well as this, there are Q&A pages and community message boards for you to connect with other QuickBooks customers. If you need a helping hand, why not take advantage of QuickBooks’ team of experts or bookkeeping service?

If you’re unsure which subscription plan to opt for, you can contact the sales team at 1-877-683-3280, Monday-Friday, 5 AM – 6 PM.

| QuickBooks Support |

|---|

| Alternative to QuickBooks – Xero |

| Xero is cloud-based accounting software that strives for simplicity and efficiency. It offers a suite of features to cover financial reporting and management. The affordability and versatility of Xero have made it a market leader for accounting software. |

| Comparing QuickBooks to Xero |

| Xero shares many of the same features as QuickBooks, such as expense management, payroll, and tax calculations. Xero is a more affordable software product and has an unlimited number of users. However, QuickBooks has a broader range of subscription plans and unique features. |

│Conclusion

│Conclusion

QuickBooks is a fantastic option if you’re looking for solid, cloud-based accounting software.

This software is loaded with tools and features that help efficiently manage your business’ finances.

Understanding your business’ finances can be challenging, but manage the money going in and out of your accounts. QuickBooks provides simple solutions to complex problems. With QuickBooks, you can view

You can take care of your customers, employees, and vendors via one intuitive platform. Regardless of the industry, you’re in or the size of your business, QuickBooks can work for you.

Try QuickBooks Now!

QuickBooks is a simple accounting solution for businesses of any description. Whether you’re a small business owner just starting out or an experienced entrepreneur seeking new software, QuickBooks is the one for you!

Frequently Asked Questions (FAQ)

Author

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.