│Airwallex Overview

│Airwallex Overview

The world today is vastly different from a few short years ago. The way that we do business internationally is faster, smarter, and much more flexible than ever before. You need a flexible financial service provider that assists you in this new digital era.

Airwallex is the one solution you need to embed payment links across your invoices so you get paid faster. Utilize trackable links or generate QR codes, providing a clear method of payment without the wait.

Create multiple accounts from domestic to international accounts, operating in varying currencies to meet your needs fast!

Airwallex is best for collecting, managing, and spending your money domestically and internationally. Ensure that all payments made and received are tracked and recorded fully

Read our complete Airwallex review to discover the benefits of this software application and how it compares to the rest! Our Genius Score provides you with a swift and accurate idea of how Airwallex can help you and your business.

| Airwallex – Best for collecting, managing, and spending money from your business account.  | Airwallex makes international business easier, crossing currencies and aiding trackable online payments. |

│Pros & Cons of Airwallex

│Pros & Cons of Airwallex

Airwallex ensures that you can send and receive money internationally in just a few quick clicks. But, what are the overall pros and cons of using Airwallex in your business?

Airwallex Pros

One financial suite

One financial suite

Grow your business in one place with Airwallex, ensuring that you can manage money domestically and internationally.

Expense management

Expense management

Track, manage, and analyze your expenses, knowing where your business money is going when utilizing Airwallex.

Reduced fees

Reduced fees

Airwallex charges fewer fees than other financial services, saving you money whilst boosting your productivity with zero monthly costs.

Enhanced customer experience

Enhanced customer experience

Trackable links and QR codes built into your invoices make customer payments simple and straightforward.

Local and global accounts

Local and global accounts

Create local accounts in your domestic country or global accounts to deal with foreign currencies and transactions when using Airwallex.

Corporate cards

Corporate cards

Use Airwallex to keep all your business finances in one place, linking corporate cards to your Airwallex account.

Digital wallets

Digital wallets

Incorporate the latest digital technology into your Airwallex account, utilizing digital wallets for increased ease of use.

Collect payments

Collect payments

Customers can send you payments simply via Airwallex through online payments, links, and QR codes using domestic and international account details.

Spend your money

Spend your money

Pay your own payments and expenses using Airwallex, keep up to date with your own payments, and keep track of your finances.

Great rates

Great rates

Get access to the latest FX rates, utilizing many different currencies to suit your business practices.

Airwallex Cons

Not all countries are catered for

Not all countries are catered for

Whilst most major countries and currencies can be used in the Airwallex software application, some countries are out of bounds.

Varying fees

Varying fees

The fee you pay will depend on the currencies in question and the amount of money involved.

Accounts are not guaranteed

Accounts are not guaranteed

Your eligibility to open an Airwallex account depends on several factors, predominately the country where your business is registered.

| Airwallex Advantages | Airwallex Disadvantages |

|---|---|

Try Airwallex Now!

Use Airwallex today to make and receive payments domestically and internationally, utilizing a complete financial suite for all of your business finance needs!

│What Is Airwallex?

│What Is Airwallex?

Airwallex offers a fast method to make and receive online payments, domestically and internationally. By providing a fintech platform for businesses, Airwallex ensures that you manage your money effectively, improving the way that your business functions.

Airwallex is a great service for all types of businesses and is suitable for all business sizes. The key unique selling point of Airwallex, however, is the ability to make and receive payments that cross different currencies and countries.

Fees remain low to encourage repeated use of the Airwallex financial infrastructure, offering multi-currency business accounts with favorable FX rates. Transfers are made instantly, helping your business to move swiftly onto the next sale or purchase!

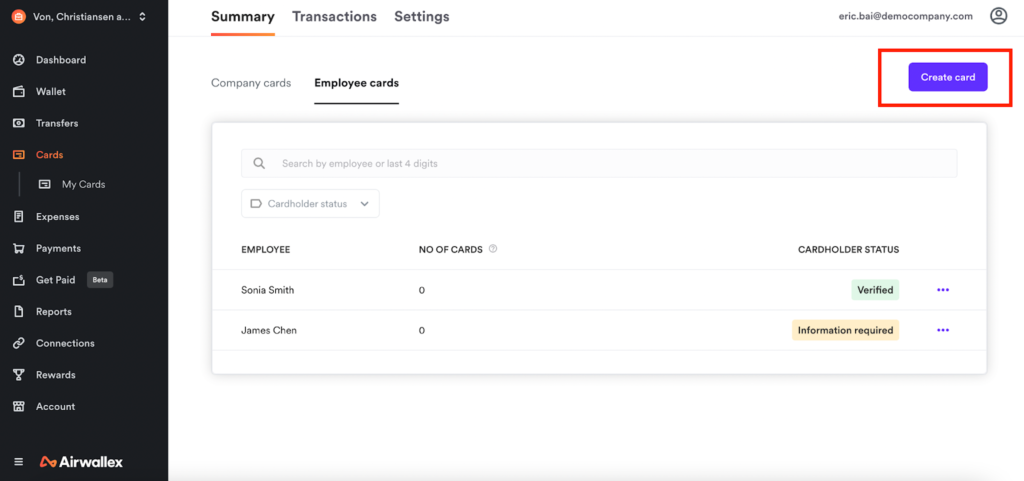

Airwallex allows you to create virtual debit cards that can be transferred to a digital wallet. These virtual debit cards can be given to employees with set spending limits to pay for and track business expenses.

To receive payments from customers, use Airwallex to embed trackable links or QR codes into your invoices. Customers can pay you faster with just a few quick clicks!

To enhance Airwallex further, integrate with Xero. Multi-currency transactions can be synced automatically to Xero, updating your records effortlessly.

To use Airwallex, simply register your details and set up an account. Your business details will need to be verified and you need to choose the countries and currencies applicable to your business.

Various documentation will need to be uploaded also and it may take a couple of days for Airwallex to review your information. Once fully set up, however, customize your Airwallex account straightaway to manage money your way!

│How Does Airwallex Work?

│How Does Airwallex Work?

Airwallex works to create a global financial infrastructure for your business. Send and receive international payments faster than ever before, paying low fees and accessing different currencies.

Receive payments from customers by embedding QR codes and trackable links into invoices. You will get paid faster and reduce the waiting time between sending an invoice and receiving payment.

Pay your own expenses simply when using Airwallex. Set up virtual debit cards with spending limits so you can track and manage employee expenses. Uploading your virtual debit cards to digital wallets makes this process easy to manage!

Setting up your Airwallex account is free, although not every Airwallex application will be accepted. Your documents and business information must be verified before an account with Airwallex has been successfully created.

Once set up, fees will arise depending on your usage. For example, an FX currency conversion fee of 0.5% to 1% will apply. You will also be charged $9 per additional employee cardholder per month, although the first five are free of charge.

│Features of Airwallex

│Features of Airwallex

Airwallex is a global financial infrastructure that works to help your business grow and prosper! You can send, manage, and receive money from around the world, quickly and with zero hidden fees.

Airwallex has achieved an impressive Genius Score due to the vast array of features this software application offers.

Receive payments

Receive payments

Payments can be sent to you online or through using links, providing a simple way to receive the money owed to your business.

Links

Links

Receive your payments faster using SMS links, embedded invoices, and emails. Customer payments will be made quickly when you use Airwallex!

Business accounts

Business accounts

Merge your domestic and international accounts into one place when using Airwallex.

Currencies

Currencies

Many currencies are accepted by Airwallex, helping your business reach various corners of the world.

Transfers

Transfers

Make your own payments effortlessly, paying fewer fees than Airwallex’s competitors.

Borderless cards

Borderless cards

Create and manage virtual employee debit cards when using Airwallex, setting limits, and tracking spending.

Expenses

Expenses

Know exactly how business expenses are being spent, using Airwallex to manage and track expenses.

Xero integration

Xero integration

Integrate Airwallex and Xero to record and manage your records, requiring little input from you.

Why do We need to Use Airwallex?

Airwallex works for everyone!

Discover how much easier business transactions are by using Airwallex to send, receive, and manage your transfers! Whatever size and type of business you own, Airwallex will help to improve the way that you look after money.

│Who Should Use Airwallex?

│Who Should Use Airwallex?

How much experience do you have in business? Whether you are a new start-up beginner, a mid-level business success story, or a thriving expert on the global stage, you need Airwallex!

Follow our Airwallex review to see how you can benefit!

Beginners

Beginners

Have you recently started a new business? Are the number of financial requirements you are facing making you feel as though you are drowning in paperwork?

Choose Airwallex for a simple and traceable global financial infrastructure, ensuring that you send, receive, and manage your money successfully.

Beginners in business have enough stress on their shoulders trying to get their new business up and running. Let Airwallex relieve some pressures for you!

Mid-Level

Mid-Level

Are you a mid-level experienced business person who wants to focus more on international business?

Airwallex can help you make the jump between domestic and international business transactions, keeping fees low and simple. Many countries and currencies are accepted, so use Airwallex today to help your business thrive around the world!

Experienced

Experienced

Even experienced business people need a helping hand to manage their many tasks! Use Airwallex to ensure that your finances are managed and tracked in full. Integrate with Xero to record transactions and lighten your workload further!

| Usage |

|---|

Try Airwallex Now!

Manage your business accounts in full when you use Airwallex! Ensure that all transfers are made quickly and are tracked and linked into your business records. Save money on fees and develop successful links across the globe!

│Airwallex Time and Cost

│Airwallex Time and Cost

Airwallex is a free service, consisting of zero monthly fees or subscription costs! You will be charged a small percentage FX margin fee of under 1%, a fraction of the cost of similar services provided by banks.

For example, Westpac charges a monthly fee of $10 per month and a 4% FX fee, in addition to a 3% international transaction card fee. Those fees and charges soon add up and can cost your business a substantial sum! Airwallex offer this service will no hidden fees, just a low fee per transaction.

Sending, receiving, and managing your domestic and international business accounts with Airwallex saves you time! There is no need to switch between software applications as all transfers and tracking can be provided in one place. Integrating with Xero will save you further time, automatically recording transactions for your financial records.

│Usability

│Usability

Airwallex features highly in the Genius Score rank but does Airwallex deliver on its promises and USP? Review our complete Airwallex review to find out!

The aim of Airwallex is to provide a global financial infrastructure that helps you to manage domestic and international business accounts and transactions.

Once you have fully set up your Airwallex account, sending and receiving money is so straightforward! The Airwallex platform is clear and concise, offering an easy-to-use platform that is appealing to the user.

Airwallex’s USP is to create a financial infrastructure for global business, providing a single financial suite for all transfers. Airwallex truly delivers on this promise, ensuring that all transactions are managed and tracked easily and effortlessly.

│Airwallex Pricing – What Does It Cost?

│Airwallex Pricing – What Does It Cost?

Airwallex is a free financial infrastructure and single financial suite, helping you to send and receive transfers across the world. There are no monthly fees and no international transaction card fees.

Airwallex charges a low fee when you make transfers in different currencies, a fraction of the cost of their competitors. This fee is typically below 1%, in contrast with competitors such as ANZ which charges 3%, and the Commonwealth Bank which charges 4%.

Discover Airwallex today!

Airwallex is free for you to use so what are you waiting for? Apply for an Airwallex account today so you can manage your domestic and international business accounts in one simple software application.

│What Tools Are Included With Airwallex?

│What Tools Are Included With Airwallex?

What tools can you expect to use when utilizing the Airwallex financial suite?

Create Virtual Debit Cards

Create Virtual Debit Cards

Set up virtual debit cards for your employees with a spending limit applicable to your business needs. Trace expenses to ensure business money is being spent appropriately and effectively, increasing or decreasing spending limits when required.

Manage Expenses

Manage Expenses

Track business expenses easily, approve expenditures as and when required, and store receipts in one place. All expenses can be traced if desired, enhancing your financial records.

Xero Integration

Xero Integration

When integrating with Xero, you can connect the currencies you use to your account. Ensure that all records are automatically updated when using Airwallex through your Xero integration. Financial records will be accurate, timely, and easily traceable.

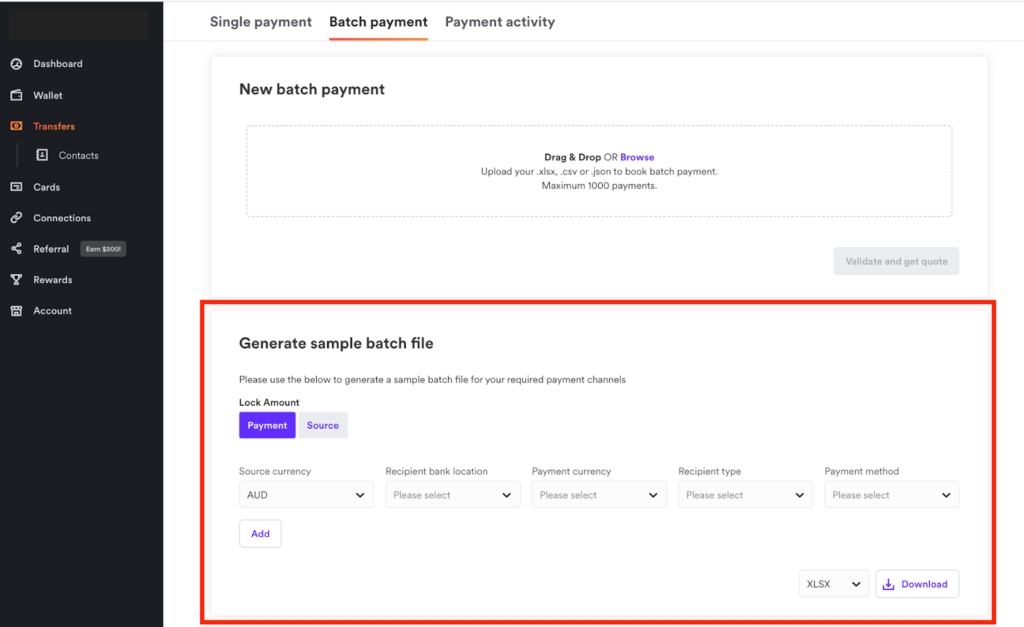

Batch Payments

Batch Payments

Generate batch payments to save you time! Simply follow the prompts on the Airwallex platform and you can set up as many batch payments as you need. All payment activities are recorded in Airwallex and can be referred to whenever you require.

| Points to Note |

|---|

│Airwallex Use Cases

│Airwallex Use Cases

Which businesses use Airwallex and would recommend this software application to others?

Business Blueprint

Business Blueprint

Business Blueprint is an education and training company that employs up to 50 employees and is based in Sydney, Australia. Due to expansion to the Philippines and beyond, a global financial infrastructure was required and Airwallex fitted the bill!

Business Blueprint loves the low fees and zero hidden costs, using direct transfers to pay their staff directly at a faster pace. Employees receive payments quicker and it takes Business Blueprint less time to pay staff!

Hawkeye Vintage

Hawkeye Vintage

Hawkeye Vintage deals in vintage fashion across the globe. They were concerned that changing currency rates resulted in less money being received when using a banking service.

Using Airwallex now means that Hawkeye Vintage knows the currency rate and how much money will be sent and received. All data is located in the Airwallex financial suite, ready for Hawkeye Vintage to act!

Coconut Bowls

Coconut Bowls

The eco-friendly brand Coconut Bowls recommends using Airwallex due to the fast international transfers and low fees. Coconut Bowls realized a 3% increase in profit margins due to the use of Airwallex in appealing to the global market. Visibility was increased and savings were made in expenses due to the virtual debit card usage.

│Support Quality

│Support Quality

What support is offered by Airwallex if you need assistance? The prime method of support is completing an online form on the Airwallex website, tailored to your problem or issue. An Airwallex expert will contact you as soon as possible with a remedy.

The Airwallex website is also awash with frequently asked questions and guides that address many different issues.

For telephone support, Airwallex has local customer support worldwide. The United States customer support team can be contacted at +1 855 932 3331 between the hours of 08:00 – 18:00 PDT/PST.

A fantastic Genius Score has been achieved for Airwallex as a result of the customer support quality received by users. However, a live chat function is not yet available from Airwallex, which would enhance their customer support quality even further.

| Airwallex Support |

|---|

│Conclusion

│Conclusion

Airwallex makes it easy for you to send and receive international payments, maintaining all business accounts in one place! Your customers can pay you using SMS links, invoice embedded links, or QR codes, ensuring you get paid faster.

You can make your own payments and ensure that you are never late to pay your suppliers and employees. You will save time when spending less time making payments due to the easy-to-use Airwallex platform.

Airwallex is free to use and most functions are completely free, also. A fee is payable when using different currencies inside of your transfers, although this fee is low compared with competitors. There are no monthly fees, international transfer card payments, or any other hidden costs.

Access support local to your location through phoning one of Airwallex’s international customer service teams. Or send a completed online form, or search FAQs and resource guides.

So, how does Airwallex compare against its top competitors? A leading Airwallex competitor is Amazon Pay, offering a reliable service that rests heavily on its brand.

However, Airwallex is made for business and offers a dedicated service for business accounts. Airwallex’s integration with Xero accounting software heightens the tailored service provided to businesses like yours.

A further Airwallex competitor is Thryv, offering a service for small businesses to manage money, pay bills, and receive payments. However, Thryv only supports the English language, alienating many potential customers globally. Airwallex supports six different languages, providing an accessible service for all and dominating its competitors.

Try Airwallex today and use digital financial services to their fullest capabilities, making your business finances simple!

Try Airwallex Now!

Airwallex makes sure that sending and receiving money across the globe is no longer a difficult task!

With low fees and no hidden costs, try Airwallex today to simplify your business accounts and transactions. All transfers and transactions are recorded to save you time with record keeping.

Frequently Asked Questions (FAQ)

Author

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.