What is Value Sense?

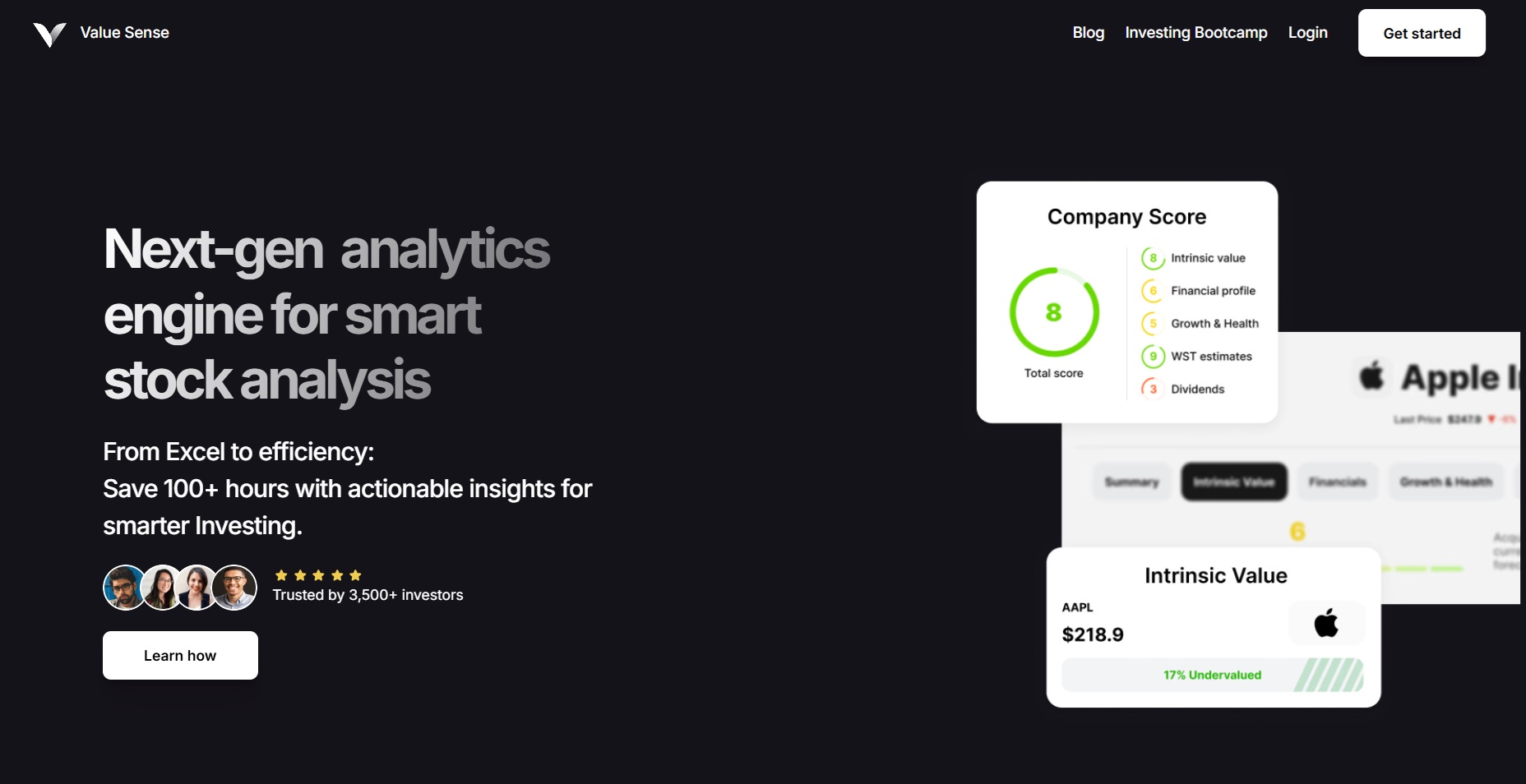

Value Sense is a modern investment platform designed to empower both novice and experienced investors with tools and insights that were once the domain of hedge funds. It aims to simplify the investment process while enhancing decision-making through sophisticated analytics and real-time data.

Features and Offerings

Value Sense caters to a diverse audience, including:

- Retail Investors: Those looking to make informed investment decisions and build wealth.

- Aspiring Investors: Individuals taking their first steps into the investment world, seeking guidance and best practices.

- Professional Investors: Experienced investors aiming to refine their strategies with advanced market insights.

The platform emphasizes value investing, helping users develop portfolio strategies focused on undervalued companies. Value Sense claims that its index of undervalued stocks has outperformed the S&P 500 by 30%, which is a significant selling point for potential users.

Educational Resources

Value Sense also provides educational content, including guides on intrinsic value and insights into different types of companies, which can be particularly beneficial for those new to investing or looking to deepen their understanding of market dynamics.

Conclusion

Value Sense is a robust tool for anyone interested in investing. Its combination of advanced analytics, user-friendly design, and educational resources makes it a valuable asset for both beginners and seasoned investors alike.

The platform’s focus on uncovering undervalued stocks and providing strategic insights positions it as a noteworthy player in the investment technology space.

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing the best SaaS and AI tools: We offer up-to-date pricing data, new tools, blogs and research to help you make informed decisions. - How?

With accurate information: Our website manager curates all tools using our curation methodology. Our editorial team fact-check every piece of content we publish, and we use first-hand information, value metrics and leading market data.