Odd-even pricing is a psychological pricing strategy retailers use to set prices just below round numbers. Instead of pricing a product or service at a whole number like $10, odd-even pricing involves setting it slightly lower, such as $9.99.

The idea behind this pricing strategy is to create the perception of a lower price. Odd-numbered prices such as .99 or .95, give the impression of a discounted or bargain price, even if the difference is minimal.

This technique influences consumer behavior and increases sales by exploiting psychological biases related to price perception. Retailers across various industries have adopted this pricing approach as it has proven to be effective in driving sales.

Do you notice something while you browse through the shelves in a retail store—most items have their price ending in .99, .95, or .97 rather than a round number. You may wonder, what’s the reasoning behind this peculiar pricing strategy? Welcome to the world of odd-even pricing, a fascinating approach retailers use to sway consumer behavior.

Odd-even pricing has been around for a long time. According to a Marketing Bulletin report from 1997, over 90 percent of the prices advertised during that period ended with an odd numeral, showcasing the prevalence and effectiveness of odd-even pricing strategies.

MORE: Psychological pricing strategy

How Does it Work: The Psychology of Odd-even Pricing

The psychological appeal of odd-even pricing is rooted in the concept of left-digit bias—a cognitive bias that affects how individuals perceive and process numerical information. The left-digit bias suggests that consumers tend to focus on the leftmost digit of a price when determining its magnitude.

This phenomenon implies that people are more likely to perceive a greater difference between $7.00 and $5.99, compared to $7.01 and $6.00, primarily due to the substantial contrast in the leftmost digits of the former set of numbers.

Again, $9.99 appears to be substantially cheaper than $10.00, even though the actual difference is just one cent. At first glance, the typical shopper would mentally round down to $9 instead of up to $10.

Another reason odd-even pricing is widely successful is that it has become deeply ingrained in consumer culture over time. Consumers have become accustomed to seeing prices ending in .99 or .95, and this familiarity influences their expectations about pricing.

The mere presence of an odd-ending number triggers a perception of a bargain, enticing consumers to feel they are getting a better deal. At this point, they’re excited and satisfied with the offer, so they’ll likely follow through with the purchase.

Real-Life Examples of Odd-even Pricing

Odd-even pricing is everywhere. From retail giants to popular online platforms, countless companies have used this pricing approach to drive sales. Here are some real-life examples of brands that have successfully implemented an odd pricing strategy:

In Retail

Walmart

The Walmart everyday low price tag ending in .97 instead of a whole number makes it seem like a bargain. And since we are trained to read from the left to the right, consumers are more likely to see it as $14 instead of $15, which is the actual approximate price. When consumers perceive a sale as a good deal, they are subconsciously inclined to make more purchases.

Food and Beverages

Starbucks

You can see that the prices on this Starbucks menu end in odd numbers. But more than that, you’d notice that they end in .95 instead of the more common .99 that is associated with “low price.”

Starbucks positions itself as a premium brand in the coffee market. And their target customers aren’t price-sensitive consumers but people looking to get high-quality coffee, irrespective of what may seem as a slightly higher price. By using .95, it sets itself apart from cheaper coffee brands, reinforcing its premium brand image and products.

In SaaS

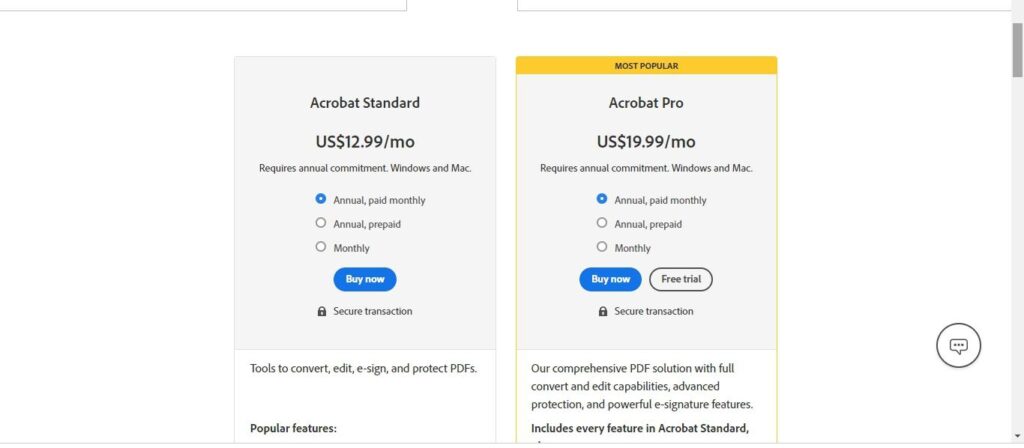

Adobe Sign

Like we have mentioned earlier, the human mind is naturally conditioned to read from left to right. Additionally, the .99 price tag is commonly perceived as a “lower price” for a product or package whenever it’s associated with a price tag. Hence, users are most likely to see these packages as $12 and $19 simultaneously, instead of $13 and $20.

It’s also important that you know that a business can incorporate more than one pricing strategy at a time. For example, the odd-even pricing strategy is not the only pricing strategy at play here. Adobe Sign also implemented tiered pricing strategy and price anchoring here.

Read more about price anchoring and tiered pricing strategy to see how you can utilize these strategies to maximize your product value and profits.

Pros and Cons of Odd-even Pricing

Odd-even pricing strategy offers incredible benefits to businesses. At the same time, it could be a drawback if implemented wrongly. Here’s a list of potential benefits and pitfalls of odd-even pricing.

Pros of Odd-even Pricing

- Increased Sales

The psychological impact of odd-even pricing increases sales whether in the traditional retail setting or B2B eCommerce sales. Shoppers are more likely to be attracted to prices that end in odd numbers, perceiving them as a discount. This general perception results in higher conversion rates and increased sales volume for businesses.

- Competitive Advantage

Odd-even pricing strategies can help companies to be more competitive in the market. By offering prices that appear lower than competitors’ rounded prices, businesses can stand out and attract more customers. It creates a distinct pricing image that differentiates the business from others and increases its perceived value proposition.

- Alignment with Consumer Expectations

Consumers have grown used to seeing prices ending in .99 or .95, and deviating from this pattern may disrupt their expectations and lead to dissatisfaction.

A classic example of this situation occurred in December 2019, when customers complained about shopkeepers rounding off the prices of cash payments. Do you see how much difference 3 cents can make in sales?

Cons of Odd-even Pricing

- Misleading Impression

Some consumers may perceive odd-even pricing as manipulative or deceptive. They may feel that businesses are trying to trick them into believing they are getting a better deal when, in reality, the price difference is minimal. This perception can erode trust and negatively impact the brand image.

- Potential Margin Impact

Depending on the cost structure and profit margins of a business, implementing odd-even pricing may have implications for profitability. Pricing products slightly lower to achieve odd-ending numbers may result in reduced margins unless volume or customer response compensates for it. Moreover, odd-numbered prices can complicate the management of accounting software.

- Reduced Lifetime Value (LTV)

While odd-ending prices may initially attract customers due to the perception of lower prices, this pricing strategy may not foster a strong sense of loyalty in the long term. Customers who are primarily driven by price may be more likely to switch to competitors offering similar or lower prices, leading to a decrease in customer retention and overall lifetime value.

How to Implement Odd-even Pricing

While the core principle of odd-even pricing lies in the perception of value, its successful implementation requires a comprehensive understanding of consumer behavior, market dynamics, and product positioning.

Here are some steps to consider when implementing this pricing strategy:

1. Analyze Market and Customer Behavior

Conduct market research to understand customer preferences, buying habits, and price sensitivity. Identify the target audience and their response to pricing tactics to determine if odd-even pricing aligns with their expectations.

To conduct reliable market research, you must define the objectives of your research and the specific data points you need to gather through web scraping. Identify the relevant platforms to your research and choose the best proxies to allow you to scrape data without raising suspicion.

2. Determine Product Segmentation

Examine the cost structure of your products or services. Identify those with lower production costs, higher profit margins, or minimal price differentiation between odd and even prices. These factors can indicate products that may be suitable for odd-even pricing strategies, as you can easily adjust them and remain profitable.

The price elasticity of demand for your products is another factor to consider. Products with relatively inelastic demand (less responsive to price changes) may not benefit significantly from odd-even pricing, while those with more elastic demand (responsive to price changes) may be more successful.

3. Assign Prices

To determine profitable prices for your products, you must factor in the costs associated with producing, distributing, and marketing them. Understanding these costs will ensure that your pricing covers expenses and allows for profitability.

Then, identify the product’s unique selling point, its benefits, and its features. This step will help you balance the perceived value of the product and its actual worth. This way, your price is neither too high nor too low.

4. Test and Monitor Results

Implement a phased approach by testing the strategy on a subset of products or in specific markets. Monitor the impact on sales and customer behavior and use the feedback to evaluate the effectiveness of the strategy.

Remember, pricing is not a one-time task. You must continuously review and refine your pricing strategy based on customer response, market dynamics, and changes in the competitive landscape.

Key Takeaway

The odd-even pricing strategy is both powerful and effective. Companies can use it to market new products, promote sales or discounts, and increase profits.

However, you need to be careful about how you implement this strategy. Unethical use of this pricing strategy could lead to losing the trust of consumers and ultimately reduce profits.

You should consider how your consumers will perceive it, whether it provides an edge over competitors, and the overall impact it may have on your company’s bottom line.

Related Posts

Frequently Asked Questions (FAQ)

Author

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.